In today’s rapidly evolving job market, the skills required to excel in any industry are continually changing. As industries become more technology-driven and dynamic, the demand for both technical and soft skills has increased significantly. A successful career in industry—whether it be in manufacturing, technology, healthcare, finance, or another sector—demands a combination of competencies that…

Author: Admin

What Are the Key Principles of Finance and How Can They Help You Build Wealth?

Introduction Finance is a broad and essential field that touches nearly every aspect of our lives. Whether you’re saving for retirement, investing in the stock market, or managing day-to-day expenses, the principles of finance play a crucial role in helping individuals and businesses make informed decisions to build wealth, minimize risks, and ensure long-term financial…

How Can You Improve Your Chances of Loan Approval?

Securing a loan can be an essential step toward achieving your financial goals, whether it’s buying a home, purchasing a car, funding education, or managing debt. However, loan approval is not guaranteed for everyone. Lenders assess various factors to determine whether to approve or deny a loan application. The process can be intimidating, but understanding…

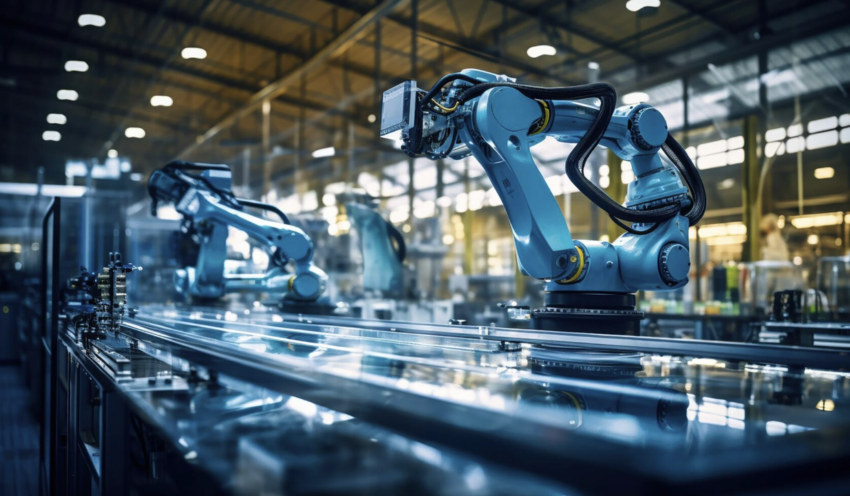

What Role Does Innovation Play in Modern Industries?

Innovation is the backbone of progress in the modern world. In industries across the globe, innovation plays a crucial role in driving economic growth, improving efficiency, and ensuring competitive advantage. The dynamic nature of technological advancements, changing consumer preferences, and the global interconnectedness of markets demand that industries adapt quickly and creatively to stay relevant….

How Can You Build a Strong Investment Portfolio?

Investing is one of the most effective ways to build wealth over time. Whether you’re saving for retirement, a large purchase, or just looking to grow your wealth, building a strong investment portfolio is essential to achieve your financial goals. But how can you build a portfolio that’s both solid and diversified? In this article,…

How Does the Stock Market Affect Personal Finance?

The stock market plays a crucial role in the economy, and its effects extend far beyond the realm of institutional investors or large corporations. For individuals, the stock market can significantly impact personal finance decisions, wealth accumulation, and financial security. From retirement savings to investments in individual stocks or mutual funds, the fluctuations of the…

What Are the Key Factors to Consider Before Taking Out a Loan?

Taking out a loan is a significant financial decision that can impact your future for years to come. Whether you’re buying a home, starting a business, paying for education, or addressing an unexpected emergency, loans can be a helpful tool. However, before you commit to borrowing money, it’s essential to carefully evaluate your decision. The…

What Are the Key Factors to Consider When Managing Your Personal Finances?

Managing personal finances effectively is an essential skill that plays a pivotal role in ensuring financial security and achieving long-term financial goals. Whether you’re just starting your financial journey or you’re looking to fine-tune your existing strategy, understanding the key factors to consider is critical. From budgeting to saving and investing, managing your finances can…

How do interest rates affect stock market performance and investor behavior?

nterest rates are one of the most significant factors influencing the stock market. Set by central banks (like the Federal Reserve in the United States), interest rates are the cost of borrowing money. When interest rates rise or fall, it can have profound effects on the economy, corporate earnings, and investor sentiment, ultimately influencing stock…

How to finance your MBA without going into debt

Pursuing a Master of Business Administration (MBA) can serve as a transformative opportunity for advancing one’s career; however, the associated financial burden frequently raises concerns among prospective students considering funding options like scholarships and loans. As tuition costs continue to rise significantly, many individuals are left contemplating how to manage this expense without incurring substantial…